2019 Property Rules And Regulations: What Agents And Landlords Need To Know

Tenant Fees Ban

Coming into force from 1 June 2019, the Tenant Fees Act aims to ensure that tenants will be able to see at a glance what a given property will cost them in the advertised rent with no hidden costs.

The new rules also mean that deposits will be capped at five weeks’ rent (or six for tenancies that cost more than £50,000 a year), and agents and landlords will be banned from charging fees for anything other than contract changes, council and utilities tax, changes to the tenancy, and issues for which the tenant is at fault.

The tenant fees ban is set to affect both landlords and agents, who won’t be able to pass on the cost of activities such as inventories, tenant referencing, and credit checks to tenants. This is a problem, because these processes all involve time, people and systems, and hence generate a cost.

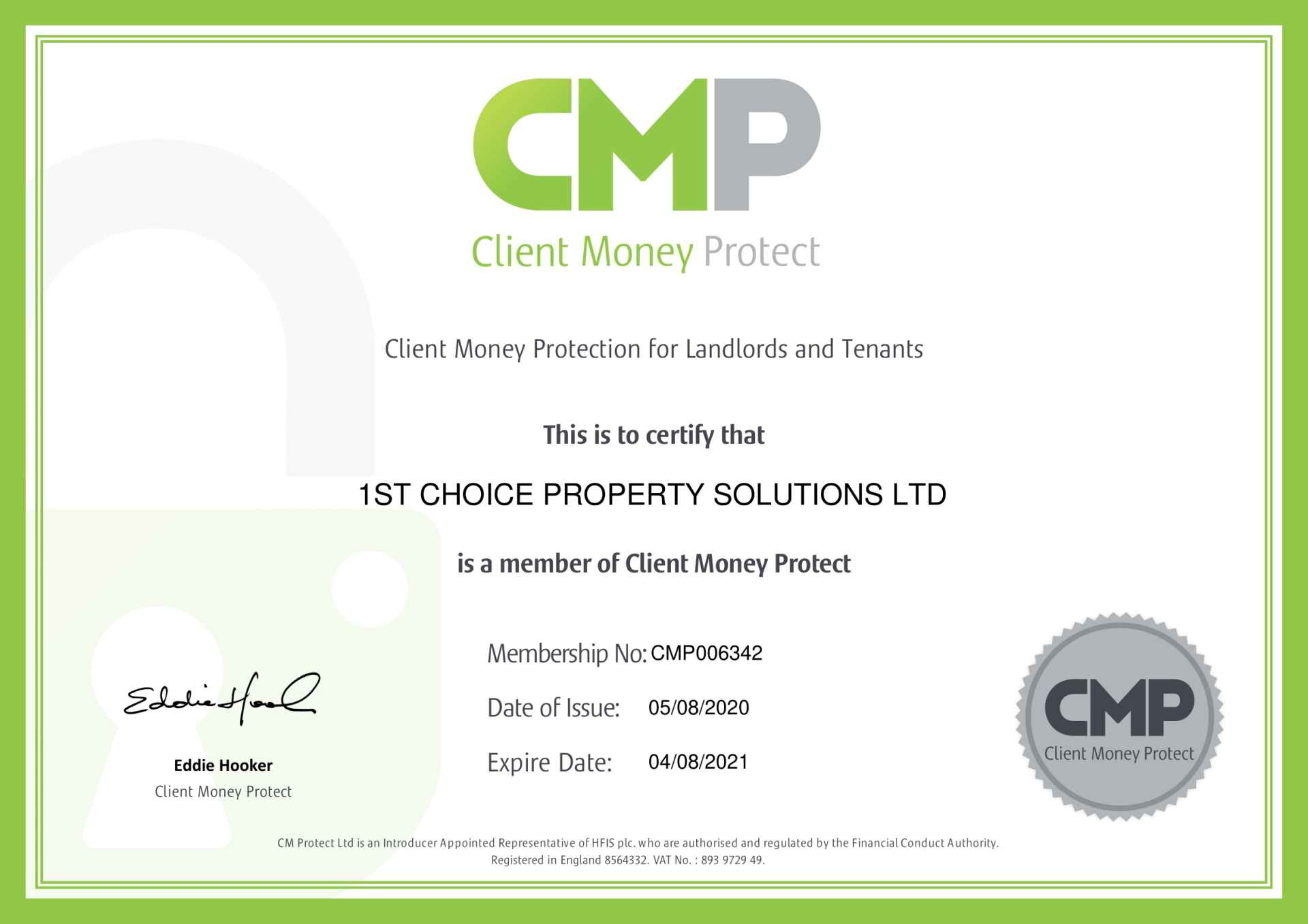

Client Money Protection scheme

Under a new law taking effect from 1 April 2019, private-sector agents will be required to join a government-approved Client Money Protection (CMP) scheme or face up to a £30,000 fine.

The new law will ensure that the client funds, including landlords’ rental payments and tenants’ deposits, will be protected. This should bring reassurance to people across the industry that their money is safe while with their agent.

Agents will need to meet a number of standards to join a CMP, such as having a separate client bank account and having professional indemnity insurance.